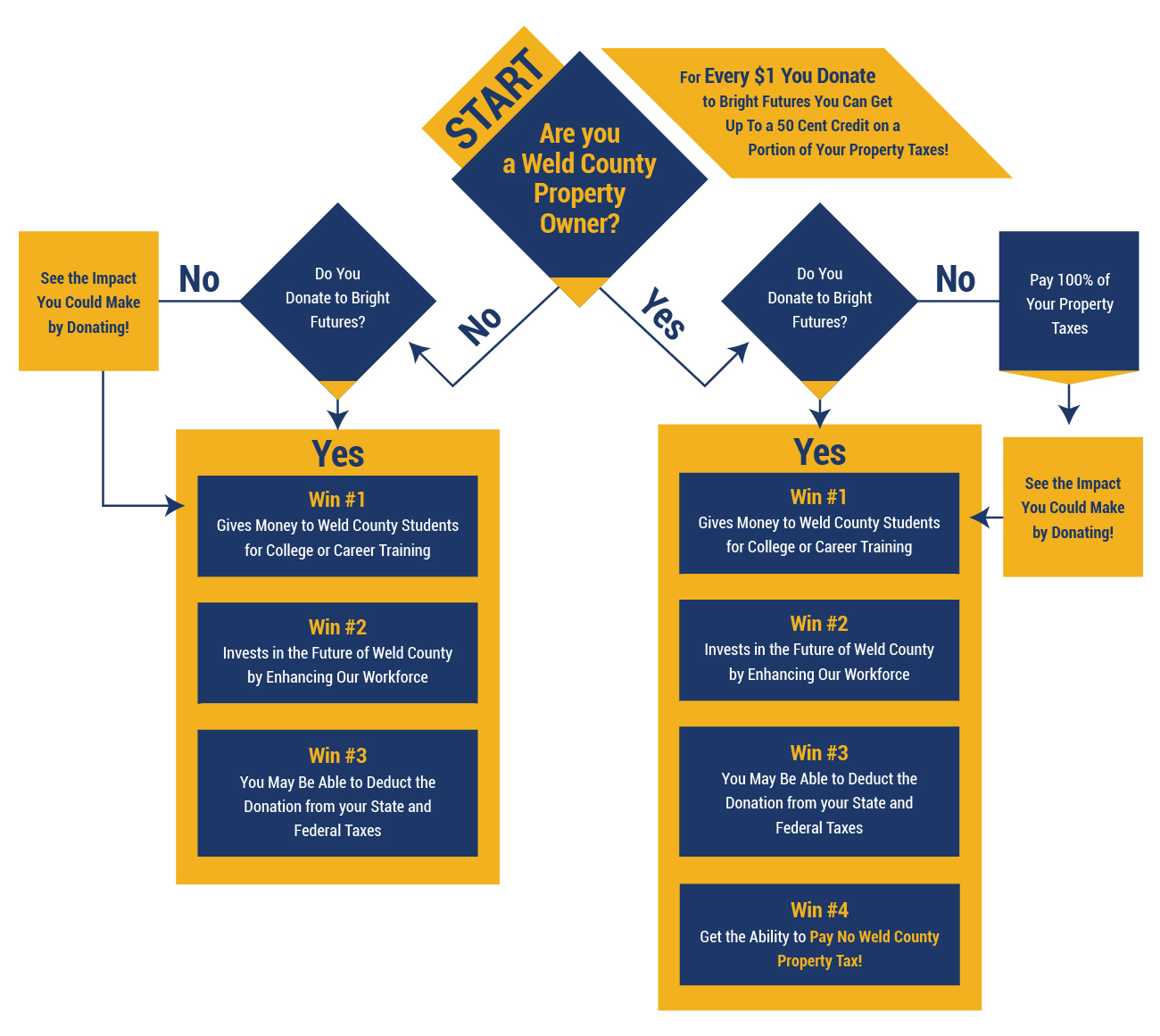

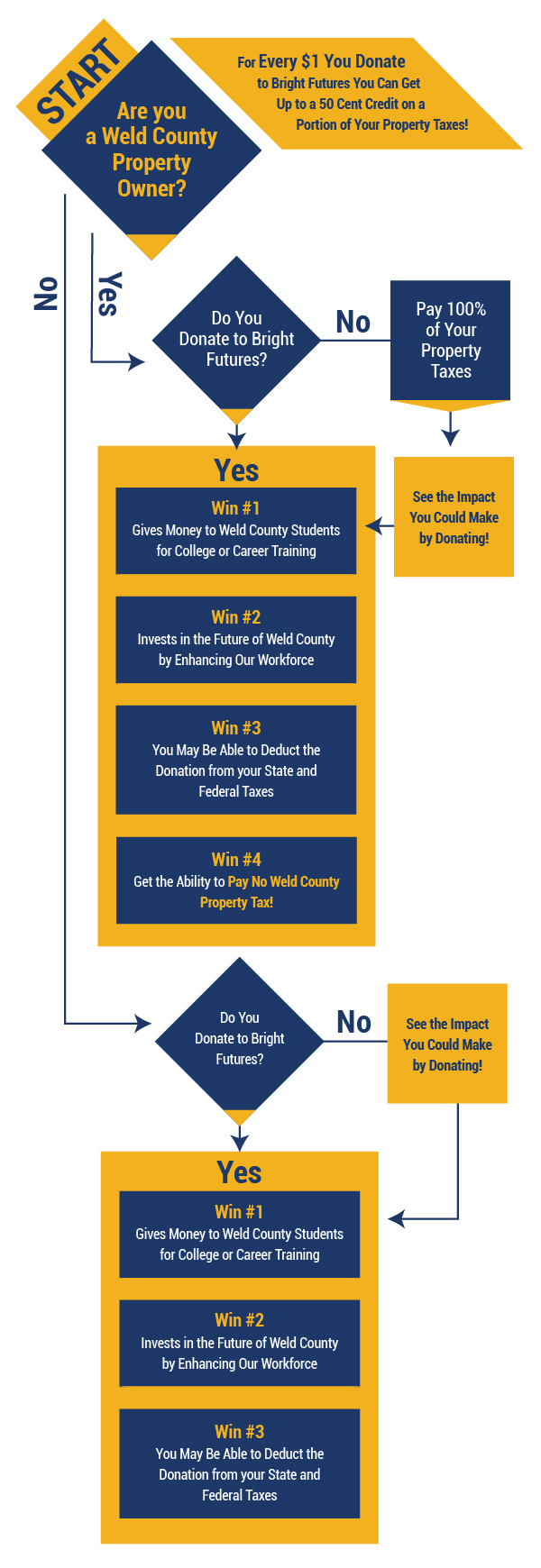

Bright Futures is administered by Weld Legacy Foundation and qualifies as a 501(c)3 nonprofit organization. You may be able to deduct your donation to Bright Futures if you itemize deductions on your tax returns, too! (Consult your tax advisor to determine the deductibility of your donation.)

If you were to donate $100 to Bright Futures, for example, and the Weld County portion of your property tax is $50 or more, you would receive a $50 credit toward the Weld County portion of your property tax. If the Weld County portion of your property tax is $50, you would pay no Weld County property tax!

If you itemize deductions on your tax returns, you may also be able to deduct your donation from your federal and state taxes, too. (Consult your tax advisor to determine the deductibility of your donation.) That means for your $100 gift to Bright Futures, you end up paying a lot less!

Bright Futures is a workforce development program established by the Weld County Board of County Commissioners to assist Weld County high school graduates and GED earners with money for college, training, or certification programs.

Data shows skilled graduates tend to remain in the area where they went to school. If they can receive help to go to school in Weld County, they are likely to stay here and contribute to the Weld County skilled workforce.

Since 2015, Bright Futures has given more than $21 million in free money for college or trade school to more than 5,875 students. This could not have been accomplished without support from Weld County residents like you.

Donations are accepted in any amount. If you are a Weld County property owner, you may receive a property tax credit of 50% of your donation on a portion of your taxes, even if your property taxes are paid through your mortgage company.

Any donation amount that exceeds twice the Weld County portion of your tax bill, will be treated as a straight donation to Bright Futures and will not be applied as a tax credit.

To donate to Bright Futures fill in the donation acknowledgement form and click the button below.

You may also donate by check. Make your check payable to Bright Futures and note the property account number on the memo line. (See your Real Estate Property Tax Notice for your property account number or the online Weld County Property Portal.)

Send your check to:

Bright Futures

PO Box 458

Greeley, CO 80632

If you have questions about your available tax credit, we encourage you to call Weld County Treasurer’s Office at (970) 400-3290. For other questions about the Bright Futures program, contact us at hello@brightfuturesco.com.